For the past two years, generative AI has been the dominant topic in boardrooms and business strategy sessions. It has been a whirlwind of experimentation, promise, and, for many, a dose of reality. The initial wave of excitement is now crystallizing into a more intentional, strategic focus: How do we actually get a return on this investment?

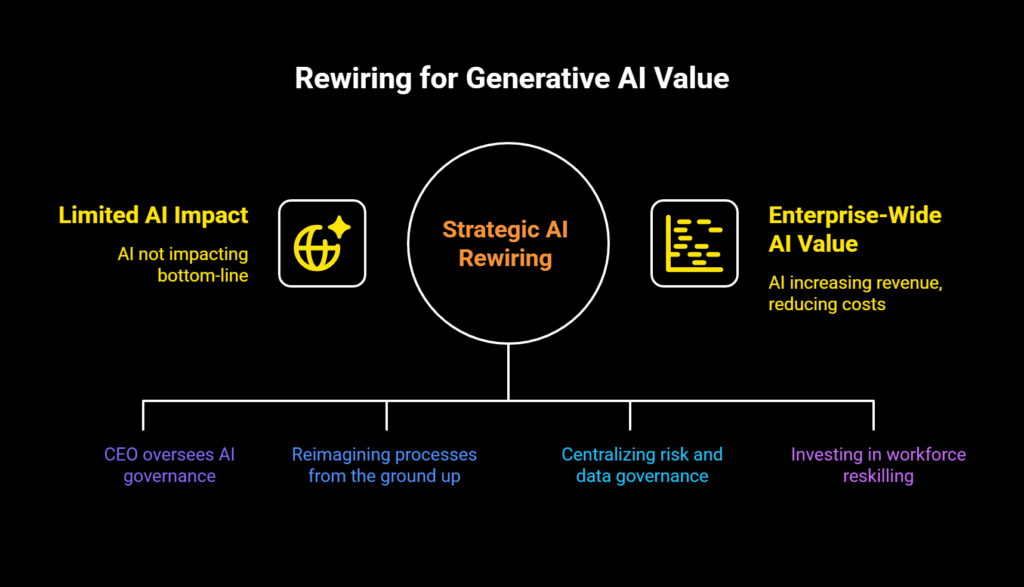

Recent global survey data on AI, fielded in mid-2024, provides a crucial answer. The organizations seeing real bottom-line impact are no longer just tinkering with chatbots and image generators. They are undergoing a fundamental “rewiring”, redesigning their very structures, processes, and strategies to embed AI into their core operations.

This shift marks the transition from AI as a novelty to AI as a core engine of value creation. Here’s how the leaders are doing it.

1. Leadership from the Top: The CEO as the Chief AI Architect

One of the most striking findings from the data is the direct correlation between CEO involvement and financial success. The analysis reveals that CEO oversight of AI governance is one of the elements most correlated with higher self-reported bottom-line impact from generative AI. This is especially true at larger companies, where the CEO’s active role has the most significant effect on EBIT attributable to AI.

Why is this so critical? As one senior AI leader noted, “Effective AI implementation starts with a fully committed C-suite and, ideally, an engaged board.” The instinct to delegate AI to the IT or digital department is a recipe for failure. Gen AI is not just a technology upgrade; it’s a transformative change management initiative that requires executive-level decisions on resource allocation, risk tolerance, and strategic direction.

This top-down commitment ensures that AI initiatives are aligned with business objectives and have the cross-functional clout to overcome organizational silos, a prerequisite for scaling beyond isolated pilots.

2. The Workflow Revolution: Where the Real Value is Unlocked

If leadership sets the stage, then redesigning workflows is the main act. The data identifies this as the single biggest factor affecting an organization’s ability to see EBIT impact from gen AI.

Yet, only 21% of respondents say their organizations have fundamentally redesigned at least some workflows. This is the crux of the “rewiring.” It’s not about using AI to do the same things slightly faster; it’s about reimagining processes from the ground up.

For example, a marketing team isn’t just using AI to write email subject lines; it’s redesigning its entire content creation pipeline, from AI-assisted strategy and persona development to hyper-personalized content generation and performance analysis, all with human oversight. This is how value compounds.

3. Centralizing for Control, Distributing for Innovation

How are companies structuring themselves for this effort? The data shows a nuanced approach to organizational design. Companies are selectively centralizing critical functions while allowing for distributed innovation.

- Centralized: Functions like risk and compliance and data governance are most often fully centralized (e.g., through a Center of Excellence). This ensures consistency, safety, and ethical standards across the enterprise.

- Hybrid/Distributed: Conversely, tech talent and the adoption of AI solutions are often managed through a hybrid model. This allows individual business units to innovate and apply AI to their specific challenges while leveraging central resources for best practices and tools.

This balanced structure prevents the chaos of a completely free-for-all approach while avoiding the innovation-stifling bottlenecks of extreme centralization.

4. Mitigating the Growing Spectrum of Risk

As adoption increases, so does the awareness of risk. Organizations are ramping up efforts to mitigate a growing list of gen-AI-related concerns, most notably inaccuracy, cybersecurity, and intellectual property infringement.

Larger organizations are leading the charge, reporting mitigation of more risks than their smaller counterparts. However, the data reveals a significant gap in oversight: while 27% of organizations review all gen AI outputs before use, another 30% check 20% or less. This vast disparity highlights an industry still finding its footing between speed and safety, innovation and responsibility.

This has also given rise to new specialized roles, with 13% of organizations hiring AI compliance specialists and 6% hiring AI ethics specialists—roles that were virtually nonexistent a few years ago.

5. The Talent and Workforce Shift: Reskilling, Not Just Hiring

The AI talent war is real, but there are signs of easing pressure. While half of all respondents say their organizations will need more data scientists in the next year, hiring difficulty for many AI-related roles has decreased compared to previous years.

The more profound shift is happening within the existing workforce. Organizations are investing heavily in reskilling, and they expect this investment to accelerate dramatically over the next three years. The question of what to do with time saved by automation is being answered: employees are most often spending it on entirely new activities or focusing more on existing responsibilities that require a human touch.

Contrary to the dystopian fear of mass job displacement, a plurality of respondents (38%) predict gen AI will have little effect on workforce size in the next three years. The impact is functional, not necessarily existential. Headcount is expected to decrease in areas like service operations and supply chain management, while it’s anticipated to grow in software engineering and product development. AI isn’t eliminating jobs; it’s reshaping them.

6. The Proof is in the Pudding: Early Signs of Value

After months of investment, the early signs of value are finally emerging. Compared to early 2024, a larger share of respondents report that gen AI is increasing revenue and reducing costs within specific business units.

- In functions like Strategy & Corporate Finance and Supply Chain, significant percentages of respondents now report revenue increases of over 5% attributable to gen AI.

- Similarly, cost reductions are being realized, with over 60% of respondents in Supply Chain and Service Operations reporting decreased costs from gen AI use.

However, it’s crucial to temper expectations. The data clarifies that these gains are often contained within business units. For more than 80% of respondents, gen AI’s impact on enterprise-wide EBIT is not yet material. This underscores that the rewiring is a journey, and capturing value at scale remains the next frontier.

The Path Forward: Think Big, Start Smart

The message from the front lines is clear, as summarized by a senior AI executive: “It pays to think big.”

The winners in the AI era are those pursuing end-to-end solutions to transform entire domains, not those taking a piecemeal, use-case-by-use-case approach. This transformative thinking forces C-suite alignment and builds a foundational infrastructure that enables faster, cheaper deployment of future functionality, creating a competitive advantage that is incredibly difficult to replicate.

The organizations that are rewiring those with committed leadership, redesigned workflows, intelligent governance, and a focus on talent transformation are moving beyond experimentation. They are building the foundations for a future where AI is not just a tool they use, but a fundamental part of who they are and how they win.